A recent Gallup survey found black college students were more likely to graduate with debt than white students, correlating with a lower sense of well-being after college. Meanwhile, some Ohio State students are concerned that the university is not doing more to help.

The survey results were based on a collaborative effort between Gallup, Purdue University and Lumina Foundation in the first Gallup-Purdue Index to “study the relationship between the college experience and college graduates’ lives,” according to Gallup’s website.

Gallup surveyed a random sample of 29,560 people living in the U.S. ages 18 and older with a bachelor’s degree or higher and who had access to the Internet from Feb. 4 to March 7.

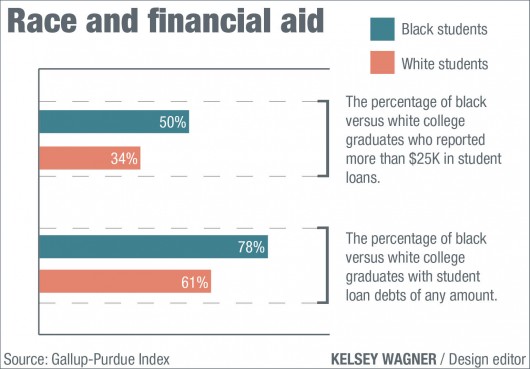

The results showed that 50 percent of black graduates reported more than $25,000 in student loan debt, compared to the 34 percent of white graduates who reported similar levels of debt.

Furthermore, the survey revealed that from 2000 to 2014, black college graduates were 17 percentage points more likely to graduate with debt of any amount over white college graduates. This number has been almost constant since the 1970s.

So what exactly do all these numbers mean?

Brandon Busteed, executive director of Gallup Education, said the gap should be smaller.

“In simple terms, there is more work we have to do as a country and as a higher education system to make college more affordable — for everyone — but especially underrepresented minorities and middle-to-lower income families,” Busteed said in an email.

He was unable to offer any reason behind the borrowing gap between white and black college students.

“There are likely a number of factors contributing to this, and more research is needed to help understand the various nuances of ‘why,’” Busteed said. “But one thing is clear: black graduates are leaving higher education with the most debt of any group — even more so than other minority groups such as Hispanic and Asian graduates.”

Gallup has also done research into the link between large amounts of student debt and a lower sense of overall well-being.

With that research in mind, the same survey found that black graduates, with their statistically larger chance of having more debt, reported a lower sense of overall well-being than white graduates did.

“In Gallup’s previous research, we have found that graduates who have more than $25,000 worth of student loan debt experience detrimental impact on their overall well-being for as long as 25 years or more post-graduation,” Busteed said. “This is true for anyone with large amounts of student loan debt, and especially for black graduates — who are more likely to graduate with larger debt amounts than all others.”

The margins of error of the survey were ± 1 percentage point at a 95 percent confidence level, according to Gallup’s website.

OSU keeps record of how many students of each race are enrolled during any academic year. For example, OSU’s statistical summary for Autumn 2013 reported there were 3,753 African-American students enrolled at the university.

Keeping track of racial statistics does not extend to financial aid, however.

University spokeswoman Amy Murray said in an email that there is no information available on the difference in aid awarded to individual minorities.

“The university does not track data based on financial aid and race,” Murray said.

When filing the Free Application for Federal Student Aid, or the FAFSA, the form does not ask students for their or their family’s race, Murray said. So it is not something that OSU — or the U.S. Department of Education — tracks at all.

Some students, though, said they wished OSU kept track of financial aid and race.

Angelle Bradford, a 2014 graduate in microbiology, said she was disappointed in OSU for not keeping track of how much financial aid goes to students of color.

“OSU is so big on research and keeping up with data,” Bradford said. “I would have certainly thought that they would keep track of that sort of information.”

Bradford said she thinks that OSU should be doing more to keep track of who financial aid is going to, especially given the results of the Gallup survey.

“You can’t really ignore race in terms of income and financial need,” Bradford said. “All of those things are pretty interlinked.”

Shelbie Krontz, a third-year in English education, also said OSU should adjust its policy to keep record of information pertaining to financial aid and race.

“Colleges should be keeping track of where their money goes,” Krontz said.

Busteed said universities, families, lenders and state and federal government can all play a role in addressing the issue of race and education.

“Clearly there is more we can all do to help get more black students into, through and out of college with as little student loan debt as possible,” he said.